Our Mission

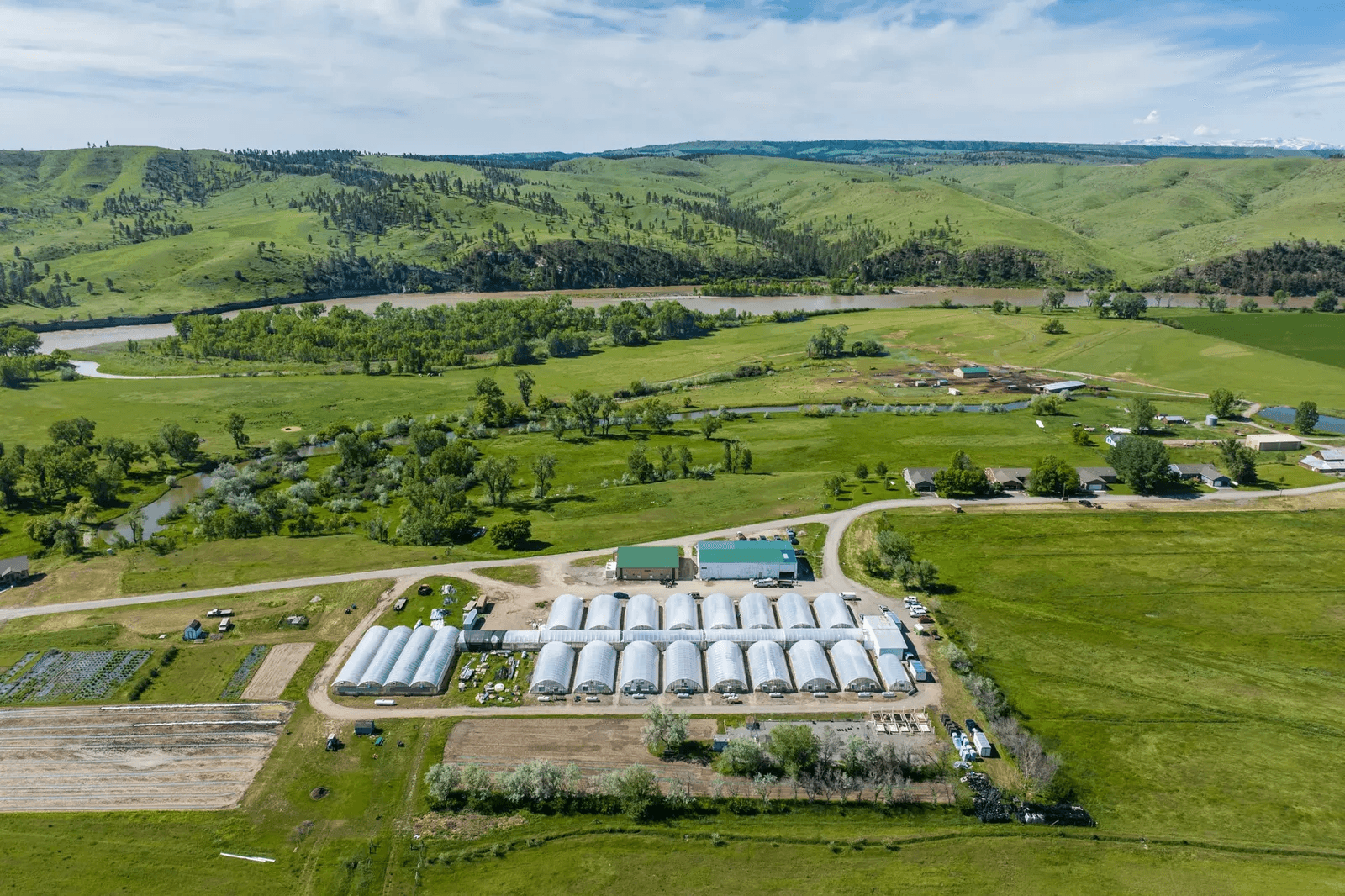

Providing family-oriented Christian homes, on a working ranch for adults who have developmental disabilities.

Learn how to assist our ranchers.

Providing family-oriented Christian homes, on a working ranch for adults who have developmental disabilities.

Learn how to assist our ranchers.

$1,518,330

$157,216

March 2024 Herder

December 2023 Herder

“Special K Ranch will imprint your heart with things no other people or place can!”

~Katie McCray

“Love this place and what it stands for!!!!”

~Susan West Anderson

Powered by Firespring